Chapter 1 Gross Income Answer Key

Write problem and answer on worksheet circle answer. Time and a half.

Doc Items Of Gross Income Subject To Regular Tax Nyrhr Ny Academia Edu

TNCT Module 5-6 - TRENDS NETWORKS AND CRITICAL THINKING.

. The car salesman will earn a commission of 83970. Understand why ethics is a fundamental business concept. 1 2 5 1 2.

The total amount paid during a pay period. Chapter 1 Gross Income. 9 Gross income Philippines P800 Gross income USA 600 Expenses Philippines 400000 Expenses USA.

Lesson 13 Weekly Time Card - Pg. Blitzer Robert F ISBN-10. Thinking Mathematically 6th Edition answers to Chapter 8 - Personal Finance - 82 Income Tax - Exercise Set 82 - Page 506 1 including work step by step written by community members like you.

Net pay 45310 gross pay734. Income Taxation - Answer key 6th Edition by Valencia- Chapter 1. Chapter 1-3 Study questions included.

Sections 1-1 1-2 hourly pay and overtime pay worksheet answers. Chapter 1 gross income lesson 13 weekly time card answers. Regular income tax 1.

Formulas for Calculating Earnings Hours Worked x Hourly Rate Regular Pay Overtime Hours Worked x Overtime Rate Overtime Pay Regular Pay Overtime Pay Gross Pay Answer. 15 415 _____. EXAMPLE Hours Worked Rate Wages 1.

Worksheets are Calculating your paycheck pieceworkproduction work 2 Chapter 1 lesson 1 computing wages Large 18 point edition answer key for sections 1 4 Gross income chapter straight time pay Name calculating your paycheck weekly time Lesson Notes Assignment Other Unit 1 1. 7137 Directions Compute the wages for each example below. Terms in this set 12 hourly rate.

549 13 13 549 1647 549 The answer is 7137. Add tips to weekly wages. General Principles and Concepts of Taxation CHAPTER 1 GENERAL PRINCIPLES AND CONCEPTS OF TAXATION Problem 1 1 TRUE OR FALSE 1.

Summaries on human behavior. Accounting questions and answers. Lesson 12 Overtime Pay - Pg.

18Under the installment method gross income is recognized and reported in proportion to the collection from the installment sales-TRUE. SOLUTIONS MANUAL INCOME TAXATION 3rd Edition By. 1-2 Overtime Pay Assign.

Identify the users and uses of accounting. Gross income without P2720000 x 100200 P1360000 Profit from foreign operation P 1360000 Billings on foreign operation P2720000 P1360000 P1400000 Gross income within 560000 From sales to unrelated clients P3400000 x 70170 Add. Your teacher will tell you the answer.

Scarcity means human wants for goods and services exceed the available supply. Supply is limited because resources are limited. Up to 24 cash back 1-1 CHAPTER 1 Accounting in Action ASSIGNMENT CLASSIFICATION TABLE Study Objectives Questions Brief Exercises Exercises A Problems B Problems 1.

Extra pay for hours worked beyond the regular numbers of hours. Demand however is virtually unlimited. Get started for free.

Explain generally accepted accounting. Up to 24 cash back Welcome - Home. Exclusion from Gross Income CHAPTER 5 EXCLUSION FROM GROSS INCOME Problem 5 1 TAXABLE 1 Taxable.

The total amount of money comed for a pay period at the regular hourly rate. Find her total income for the week. VALENCIA ROXAS SUGGESTED ANSWERS 22 Chapter 5.

3 4 2 3. WB Page 2 1-1. Find and create gamified quizzes lessons presentations and flashcards for students employees and everyone else.

Measures of Return and Risk. Chapter 1 Lesson 1 1 Computing Wages Hours Rate Solution. View CHAPTER 4 TAX ANSWER KEYdocx from TAX 311 at Bicol University Daraga Campus Daraga Albay.

VALENCIA ROXAS SUGGESTED ANSWERS Chapter 1. Copying the solutions is a violation of the school Academic Integrity Policy. 1-51 Student Name Date KEY NUMBER TAX RETURN SUMMARY CHAPTER 1 Comprehensive Problem 1 Adjusted Gross Income Line 4 Taxable Income Line 6 Total Tax Line 12 Tax Refund Line 13a Comprehensive Problem 2A Adjusted Gross Income Line 21 Standard Deduction Line 24 Exemptions Line 26 Total Tax.

An overtime pay rate of 1 12 times the regular hourly rate. 100 READ and do 1-29 ODD. Information returns involve payment of tax and are subjects to surcharge and.

INCOME TAXATION 6TH Edition BY. Find weekly wages Step 2. 1 INCOME TAXATION 6th Edition BY.

Profit on sales to foreign operation P 1960000 P1360000 x 70170 Total The answer is A. Income Taxation - Answer key 6th Edition by Valencia- Chapter 5 1. Introduction Important concepts to emphasize.

An overtime rate of twice the regular hourly rate. In Examples 1 through 4 a commission can be earned or paid depending on who is the seller and who is the client. Pages 97-99 round to the tenth placeie 29996 would be 3000 or 25476 would be 2548.

97 READ and do 1-39 ODD. Lesson 11 Straight-Time Pay - Pg. View Notes - TAX 1 3RD EDITION-Answer Key Chapters 1-2 from TAX 1 at University of Santo Tomas.

A fixed amount of money paid for each hour of work. Answer Key Chapter 1 - Principles of Economics OpenStax. Note Taking record examples Open on Swift.

CS1 Chapter 024 - CASE STUDY FOR U ALL. Find the take-home percent of the gross pay. 103 READ and do 1-9 ALL and 11-23 ODD.

Explain what accounting is. Regular tax gross income includes all income that qualifies the gross income test in Chapter 3 but is not subject to tax under Chapter 5 and Chapter 6 b.

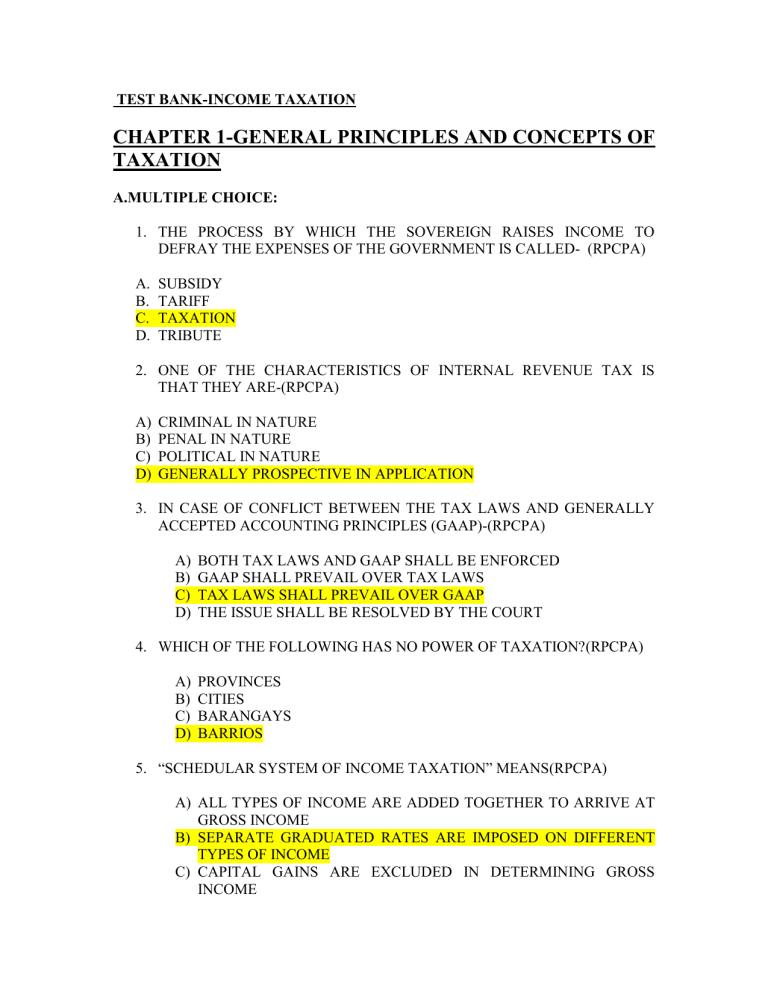

Student Copy Test Bank Income Taxation

Ch01 Solution W Kieso Ifrs 1st Edi

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis

No comments for "Chapter 1 Gross Income Answer Key"

Post a Comment